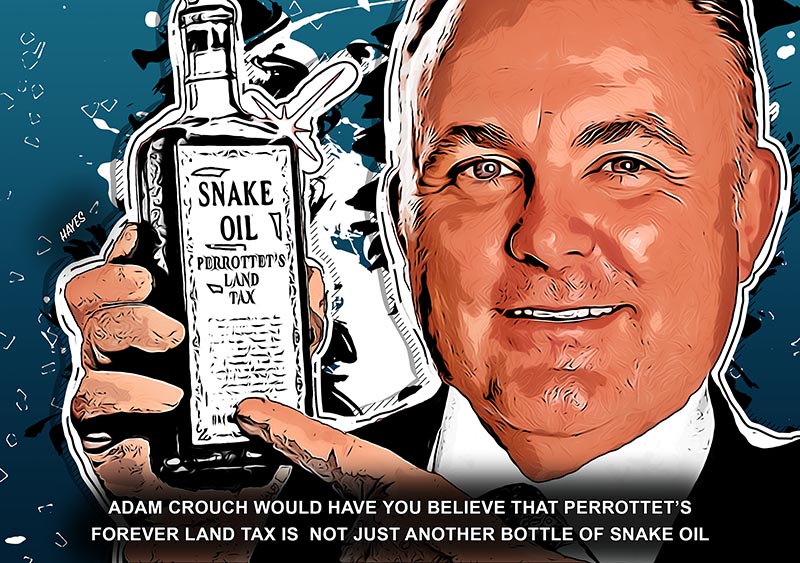

Selling government snake oil

Parliamentary Secretary for the Central Coast Adam Crouch has come out swinging over Member for Gosford Liesl Tesch’s condemnation of Perrottet’s new land tax, which recently passed into law. He said that Tesch had a “total lack of understanding” of the scheme but it is Crouch who is drowning in lack of understanding –merely ‘parroting’ his masters rhetoric as he sell's another bottle of the Perrottert government's snake oil.

13 December 2022

ALAN HAYES

DESPITE Adam Crouch’s assertion that Liesl Tesch’s condemnation of the new land tax were “gobsmacking”, Dominic Perrottet’s new land tax for first home buyers is a Trojan horse, and make no mistake it just the beginning.

If the annual ‘forever land tax’ bill becomes a financial burden, it won’t be just a simple matter of saying “let’s switch” – you still have to pay the outstanding balance, equivalent to the original stamp duty that would have been charged, less 'forever tax' payments already made.

And if a first homeowner can no longer afford the ‘forever land tax’, where will conjure up the money to make the switch? The only alternative – sell the family home! A double-edged sword that could well see many first home owners thrust back into the stamp duty market, except this time around the prices of property will no doubt have increased exponentially.

Abolishing stamp-duty and introducing an annual land tax will over the long-run result in more household expenses, placing the Australian Dream even further out of reach.

Perrottet's land tax comes at a time when interest rates are skyrocketing and the cost of living pressures are at their worst in three decades. People just don’t have the spare cash lying around in their bank accounts to pay a land tax each year, every year. And the 'forever land tax' will increase as the value of your home increases - by up to four per cent of the increased value every year. And Perrottet refuses to rule out future governments being able to increase the tax rate even further.

The ‘snake oil con’ legislation only gives first home buyers purchasing properties worth less than $1.5 million, and vacant land intended for the construction of a first home valued under $800,000, an option to pay an annual fee equal to $400 plus 0.3 per cent of the land value, instead of an up-front lump sum of stamp duty. Anything above the magic $1.5 million and it’s a no go for an alleged ‘welcoming’ annual land tax bill.

Dominic Perrottet paints an alluring picture and talks the ‘big talk’ about helping people achieve the Australian Dream but has failed to understand the long term impacts on the housing market. Perrottet’s ‘plastic wrap’ is all about what ‘Dom wants’, otherwise why wouldn’t he take his proposal to the next election to secure a mandate for his land tax on the family home?

And Crouch 'crying unfair' over Liesl Tesch's condemnation of the 'forever land tax' is tantamount to rolling out the ‘bottles of snake oil’ for a land tax that may well destroy a first home owner's dream and is a 'blind' for Perrottet's actual agenda.

So, why won't Crouch come clean about the Perrottet land tax vision?

Two years ago, Dominic Perrottet made it clear that he wanted his plan to put a ‘forever land tax’ on the family home to affect 80 per cent of properties in New South Wales – that captures more than just first home buyers and imposes a tax on homes that have already been taxed.

“What we’d like to see is about 80 per cent of properties across the state have access to this scheme.” Dominic Perrottet Press Conference, 17 November 2020.

And despite Crouch’s attack on Tesch’s concerns, claiming she has no understanding of the most basic economic principals, Perrottet, during a visit to Japan, when asked about stamp duty tax reform, said that he intended to introduce a ‘forever land tax’ on everyone’s family home – even if you’ve owned your home for forty years. And, after new home buyers, Perrottet made it clear that pensioners would be the next members of society to be gouged with his penury tax.

As previously reported by the Grapevine, several of Australia’s most respected economists and tax professionals sounded the alarm bell about Dominic Perrettot’s land tax on family homes, warning it would pump up property prices, making it harder for first home buyers to enter the property market.

AMP Capital Chief Economist Shane Oliver told The Australian Financial Review that “It does put more money into the hands of buyers and therefore can potentially push prices up, all things being equal. So, it has a stimulatory impact.”

Fady Abi Abdallah, a tax partner at BDO, issued his own warning telling the AFR ”The market is likely to quickly adjust to reflect the increased purchasing power of first home buyers, so it’s a bit of a double-edged sword as any upfront duty savings are likely to be offset by increased purchase prices,”

Meanwhile, Eliza Owen, CoreLogic's head of research, said that "it doesn’t seem to be addressing much of the affordability issue in NSW housing".

And what about Adam Crouch? He did nothing more than put his hand up to support a property tax that the Government did not have a mandate to implement. He has supported a Medieval taxation system of raising money that was previously imposed by a monarch - feudal and prerogative levies, such as forced loans and 'benevolences' that were little more than official extortion, a policy that has fast become the preferred method of raising money by the Perrottet Government.

So much for the Liberal's mantra of years gone by: 'your family home is your castle'. The 'forever land tax' will white-ant your home and assets with a Liberal feudal lifestyle – all for me and none for you.

SUBSCRIBE FOR FREE to the Grapevine News Online and to the monthly e-book edition of the Grapevine Community News. You will receive an email notification every time a news story goes live, keeping you up to date with what is happening in your community.

Our online news platform and monthly newspaper is about real local news and events. We will not spam you or share your details with third parties.

%20advert.jpg?crc=3763325189)