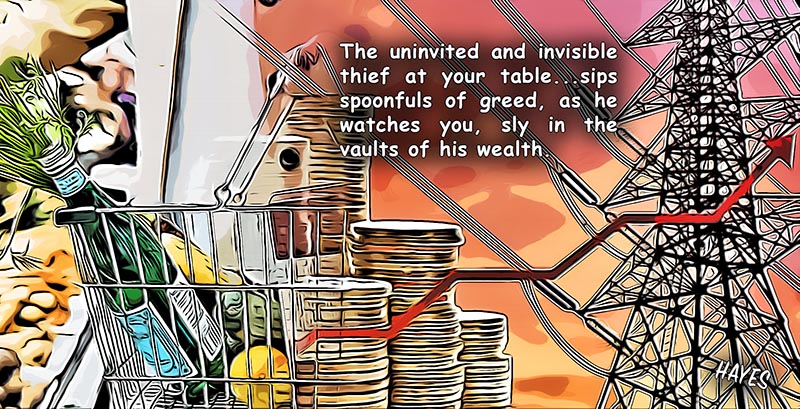

The thief who came to dinner

When you turn on the stove, whether it is electric or gas, there’s now another guest at the dining table – the unconscionable and gouging energy wholesalers who are contributing exponentially to rising energy prices and inflation. A problem that has also been exacerbated by Reserve Bank policies!

21 August 2024

ALAN HAYES

WHOLESALE energy suppliers, in particular Ausgrid, believe it is their right to charge consumers a ‘sun tax’ for the privilege of giving them free electricity during the day between the hours of 10am and 3pm, yet are prepared to throw solar panel owners a bone during the limited evening peak period when energy demands are high. A mega financial bone to suit the Ausgrid agenda. Why? Because power station owners have failed over the years to adequately maintain generators and those who own the grid have not invested sufficiently in updating and maintaining a failing power grid system. Since privatisation of the electricity grid, it’s been all about increased profits for the benefit of shareholders at the expense of the network’s customers.

Ausgrid also claim that the ‘sun tax’ was developed to reduce congestion in the electricity network, which is grappling to handle the influx of power being sent to the grid at times of high demand.

The question that needs to be asked over Ausgrid’s two-way tariff revelation:” is it simply a policy driven by corporate greed and a reluctance to invest in costly network upgrades and maintain grid stability?”

Ausgrid’s new policy makes a mockery of the federal government’s push for more solar panels and home batteries, turning their ambition to reach a net zero economy into ash. Yet Ausgrid still believe that homeowners, who have invested in solar panels to reduce reliance on fossil fuel power generation, should be punished for producing excess power into the grid – power that ultimately benefits those people who cannot afford a solar system.

Ausgrid also say that they are encouraging customers to send their exports later in the day, after 3pm, when it benefits the wholesalers peak demand, and when the grid is not congested because of lower demand.

“This tariff encourages customers to consume their own solar power first themselves or time their grid exports to later and keep energy bills lower for everyone across the network in the long term,” Ausgrid said.

But the question that hasn’t been answered by Ausgrid, “if solar panel owners aren’t able to use their excess power, how does a sun tax solve the alleged grid congestion problem?”

As electricity prices continue to rise and power generators continually break down because of poor maintenance, it seems evident that solar panel owners are to be the ‘stop gap’ to ensure the electrons keep flowing – mini power generators where they bear all the costs but receive no real benefit.

Unless solar panel owners invest in a battery, they will bear the brunt of the Ausgrid penalties, reducing the financial benefits of their solar investments.

What about natural gas?

Household gas prices are rising by more than 10 per cent, saddling families with steeper energy bills despite a mandated pause in electricity tariff increases and a federal government cap on wholesale gas prices along the east coast.

AGL Energy, one of the country’s largest gas retailers, increased gas prices in NSW as of August 1, while Origin Energy and Energy Australia introduce price changes last June.

The government’s price cap has ended up setting a floor rather than a ceiling for gas supply contracts and the higher prices (gas and electricity) is making it more difficult for the Reserve Bank to bring inflation under control.

Natural gas makes up a huge part of energy bills, particularly among Australians who use this type of energy for heating, preparing food, and using water. If you are one of them, you must have already noticed the increase or natural gas prices in Australia in the past months. The uncertainty in Europe also raises speculation about further price increases in the future.

Severe weather conditions also impact the supply of natural gas. Storms may affect the prices of natural gas as they can disrupt natural gas production. Extremely cold weather is another disturbance that affects the production of natural gas. When the demand for natural gas is high but the product is low due to weather disturbances, natural gas prices also go higher than expected – price gouging becomes mandatory to maintain already obscene profit levels.

Not surprisingly, while we, as a society, grapple with keeping the lights on and heating and cooking because of the failure to maintain electricity networks and generators, the gas industry is promoting itself on prime time television as the saviour for our electricity generation needs when the sun doesn’t shine and the wind fails to blow.

But is burning gas a better deal than burning coal so the lights don’t dim? No! Natural gas is mainly methane - a strong greenhouse gas - that invariably leaks into the atmosphere, from natural gas wells, storage tanks, pipelines, and processing plants. Gas stoves also release methane gas and other pollutants through leaks and incomplete combustion.

Natural gas may be a triumph of marketing, but the fact is that gas is a major contributor to air pollution, water pollution, and climate change.

Yet despite the obvious reasons why a match shouldn’t be waved in front of natural gas, the Federal Government’s ‘Future Gas Strategy’ still sees the importance of articulating the role of gas in the clean, affordable and equitable transition to net zero.

So, where does the Reserve Bank fit into energy greed?

As you ponder about what is likely to occur next in the Reserve Bank’s waning monetary chess game, the bank’s Governor Michele Bullock and the rest of the board can contemplate is that it actually pushed up rates on thirteen occasions since it began its attempt to restrain inflation in May 2022.

On each occasion, its rationale was that by making borrowing more expensive, it would take money out of the economy. Yet, at the same time, it has also been pushing money into the economy and potentially feeding inflation.

Michelle Bullock has agreed that the appropriate target for monetary policy in Australia is to achieve an inflation rate of 2–3 per cent – a rate of inflation sufficiently low that it does not materially distort economic decisions in the community.

But want went wrong? Historically, the Reserve Bank ensured there was just enough cash in the exchange settlement system between banks to meet the banks’ needs, neither too much nor too little. But when COVID arrived it all fell apart - in 2020, the amount of surplus cash in the system exploded, from very little in the years leading up to COVID to $450 billion. To start with, the Reserve Bank wasn’t required to pay much interest on these extra hundreds of billions because its cash rate target was close to zero. But as it lifted rates to get on top of inflation, it began to pay serious sums in interest.

So, each time the Reserve Bank has pushed up rates, it has had to pay out more in interest, which means it has been pumping money into the economy potentially feeding inflation at the same time as it announced measures to restrain it.

But did the Reserve Bank accept the blame for adding to the inflationary trend? No! Just like the punishment Ausgrid intends to foist upon solar panel owners, the Reserve Bank punished homeowners by increasing interest rates in a vain attempt to bring inflation under control.

The end game

While households struggle to make ends meet, the increasing cost of food, rising energy rates and uncertain interest rates, have crippled too many families.

All the while, cash-strapped families have to a contend with setting an additional plate at the dinner table – the financial thief who came to dinner!

.jpg?crc=4257584689)

_web.jpg?crc=282450513)